In the fast-paced world of financial markets, traders constantly seek opportunities to capitalise on market movements. One such setup that has recently caught the attention of traders is the completion of the oil retracement setup.

As both Brent crude oil and the Canadian Dollar (CAD) show signs of strength, savvy investors are keeping a close eye on these markets to identify potential bullish trends. In this article, we delve into the concept of retracement, analyse the current state of Brent and CAD, and explore the potential for further upward momentum.

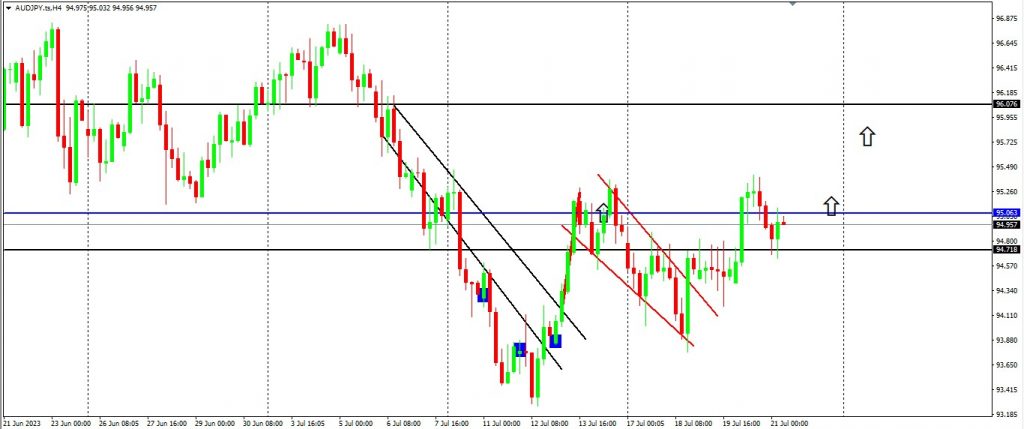

The AUDJPY Performance

The short-term movement turned to a longer wait to the upside. A bullish signal through a price pattern flag has been formed on the H1 timeframe. Target suggested taking profits at a price point of 96.076. Let us wait for another thrust above 95.063. Any daily candle close below 94.718 would be a signal to pause the setup and wait for price action.

Read More: GOLD & US30 Have Completed The Bullish Setup

The CADJPY Performance

After hitting our TP previously, around June we waited for additional data from price. An hourly time frame analysis is shown with both the inner and outer trends broken. A high and a higher is seen which signals the start of more upside. A new entry can be considered after the price breaks the high at a price point of 106.600. Please note we need hourly candles to close above signalling stronger intra-day movement as well as a new higher high.

The Brent Oil Performance

Price pushed up successfully to the breakout zone suggested at price point 78.23, it has closed above both 78.23 & 78.49. The breakout is followed by a retracement for a further push-up to the suggested target at point 84.84.

We see the retracement has been formed and the opportunity for traders to enter can be used. For the conservative trader, entry-level after both zones demarcated in blue as supply and demand as well as price point 80.77. Traders need to monitor this closely as the movement may happen quickly today or early next week.

Final Thoughts On Today’s Analysis

In conclusion, the completion of the oil retracement setup has garnered the attention of traders, with Brent crude oil and the Canadian Dollar (CAD) exhibiting strength. This could signal a potential upward trend in oil prices and present opportunities for traders to capitalise on bullish movements in the oil markets. Nevertheless, it is essential to approach trading with a comprehensive risk management strategy and consider the impact of various factors that may influence oil prices and currency markets.