Traders continue to maintain a bullish outlook on EURUSD and NZDUSD, while closely monitoring the bullish price action on GOLD. The market sentiment remains positive for these currency pairs, with several factors supporting the bullish stance.

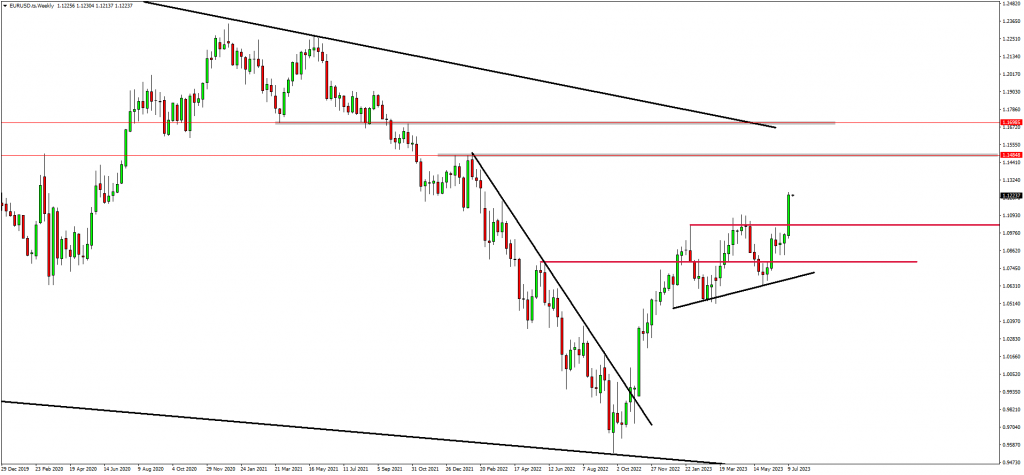

The EURUSD Performance

(UPDATE) - Is EURUSD ready for a correction?

The recent price action on EURUSD suggests that the buyers are very aggressive. The market aggressively broke above the previous structure's high levels and has also created higher lows. This price action usually confirms bullish momentum. As such, traders are still bullish and are keeping a close eye on the next targets around 1.14848 and 1.70000.

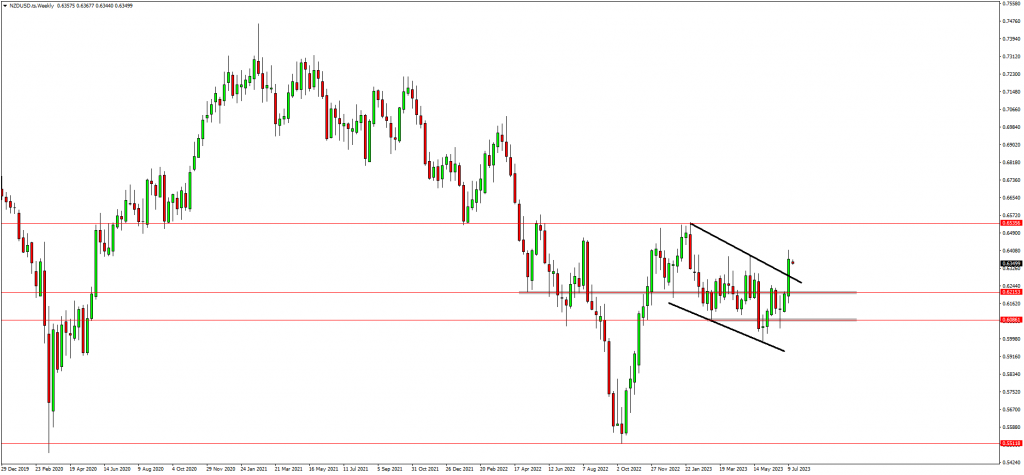

The NZDUSD Performance

(UPDATE) - NZDUSD set for 0.65000.

NZDUSD successfully broke out of the weekly timeframe's corrective structure. As far as market structure is concerned, this price action indicates a continuation of the previous impulse wave which usually pushes the market back to the start of the corrective wave.

As such, traders anticipate NZDUSD to rally back to 0.65000 which is the start of the corrective structure. Therefore, traders will use the lower timeframes to identify patterns that are in line with the weekly timeframe structure to identify trading opportunities.

Read More: How To Open A Real Account in MetaTrader 4

The XAUUSD (GOLD) Performance

Are the bulls starting to show interest?

GOLD bounced from the bottom of the descending channel and rallied to the upside. The bottom of the channel was in confluence with the 61.8 Fibonacci level of the weekly timeframe impulse wave and overall provides insight on the retracement.

Furthermore, the market also bounced from the weekly timeframe support trendline. According to this price action, traders are bullish and anticipate the weekly timeframe bullish trend to resume. However, lower timeframe price action will be key in confirming. As such, traders anticipate the market to breach the 1959.95 resistance zone to the upside and are targeting the next zone around 1983.77.

Final Thoughts On Today’s Analysis

To summarise, traders remain bullish on EURUSD and NZDUSD, given the favourable economic factors and supportive central bank policies. Simultaneously, the bullish price action on GOLD attracts traders seeking to diversify their portfolios and hedge against market uncertainties. However, it is important to note that market conditions can change rapidly, and traders should closely monitor key indicators and adapt their strategies accordingly.