The financial markets have been bustling with activity recently, and three assets, in particular, have piqued the interest of traders: XAUUSD, CADJPY (Canadian dollar versus Japanese yen), and Bitcoin. While gold has been under pressure, the CADJPY and Bitcoin are displaying potential buying signals. In this article, we will investigate the present market dynamics of these assets and examine the reasons for traders opinions.

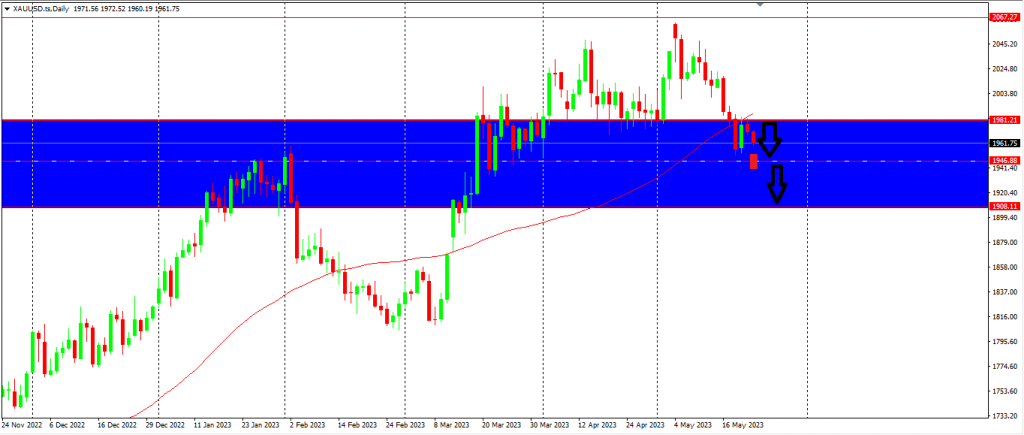

The XAUUSD Performance

Gold has moved down to the zone between price levels 1981 & 1646 as predicted short term. The US dollar is still range bound mainly due to the US debt ceiling negotiations, inflation, and interest rate decisions. At this point, Gold will continue to range within the zone identified until we see more movement from the dollar as the global reserve currency.

Keep a close eye on the US Dollar Index because the Federal Reserve is looking for a pause on the tightening campaign, meanwhile, other economic indicators like the 2nd reading of 1ST quarter GDP could create some volatility in the market.

We need a close below 1946.88 for an earlier entry. The more conservative trader may want to enter the market below 1933.60. Let’s continue to stay put until more price action develops for a clearer reading of direction.

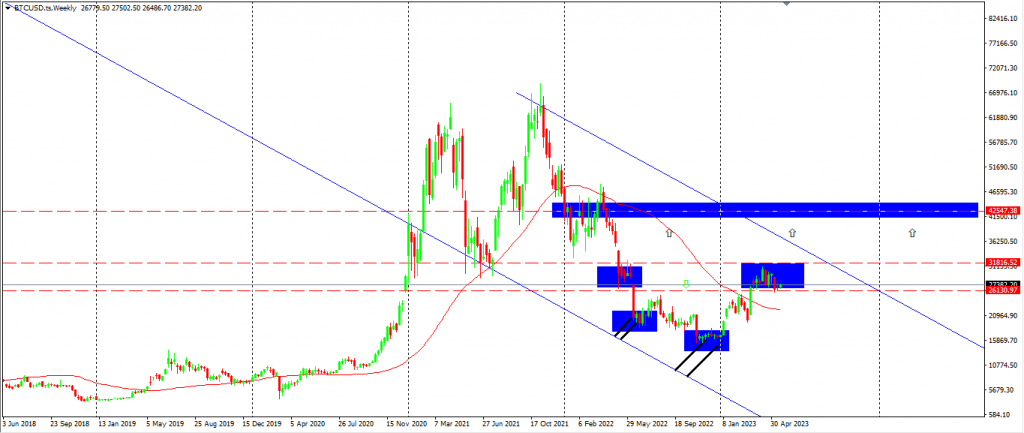

The BTCUSD Performance

Watch the correlation of the S&P500, it is not a direct comparison, however, it does provide a higher probability of direction. Overall, we are seeing a retracement, particularly on the monthly chart. Back at support level 26130.97. If the price breaks and closes above 31816.52, more upside to the price level of 42547.38.

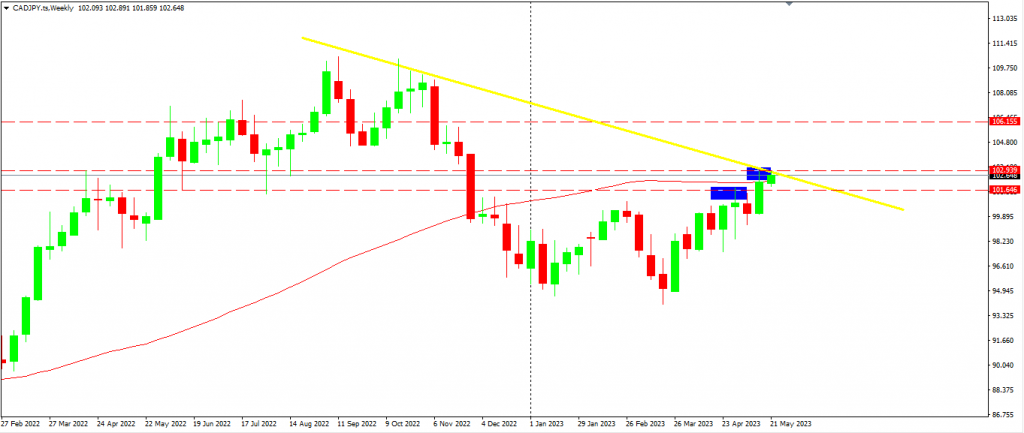

The CADJPY Performance

Currently trading at the 52-week high, a break above the average would be for a longer-term hold for buyers. A close above 102.939 is more short-term hold to target at 106.155. Monitor and look for a daily time frame close. High has been created at 101.646 & a higher high at 102.939.

Final thoughts on today’s analysis

While gold's overall sentiment remains bearish due to the previously listed variables, CADJPY and Bitcoin are exhibiting bullish indications that traders are taking note of. The Canadian dollar's strength and the Japanese yen's depreciation make CADJPY an enticing alternative for traders eager to capitalise on possible gains.

Similarly, Bitcoin's (XAUUSD) rebound and increasing institutional interest make it an appealing asset for anyone looking to gain exposure to the cryptocurrency sector.