Traders around the globe are keeping a close eye on the financial markets, particularly the US30, GOLD, and USOIL, as concerns mount over their short-term performance. Despite recent gains in these markets, many traders are expressing a cautious outlook and taking a bearish stance.

The US30 Performance

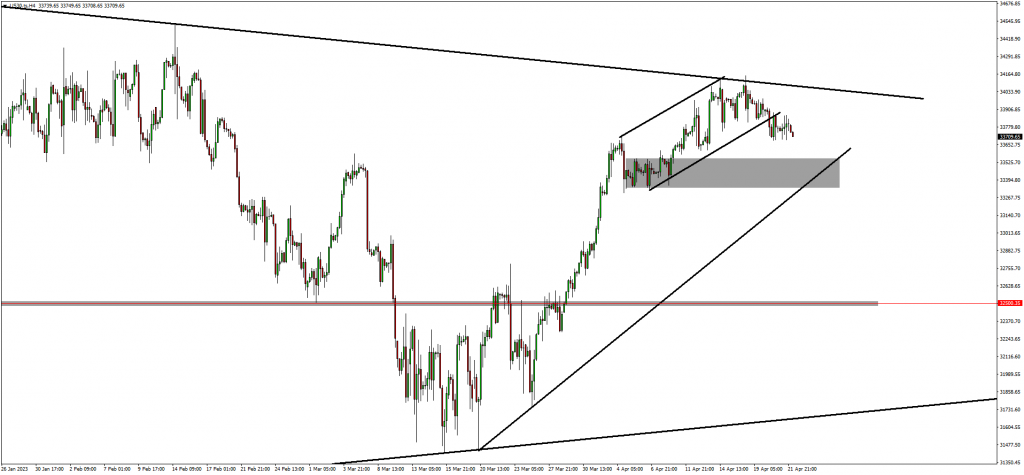

(UPDATE) - US30 retracement is confirmed.

US30 recently broke below the ascending structure. This price action formed after the market rejected the weekly timeframe resistance trendline. Traders are still long-term bullish according to the weekly timeframe structure however are short-term bearish due to the H4 timeframe price action with targets set at the demand zone and the ascending trendline.

The USOIL Performance

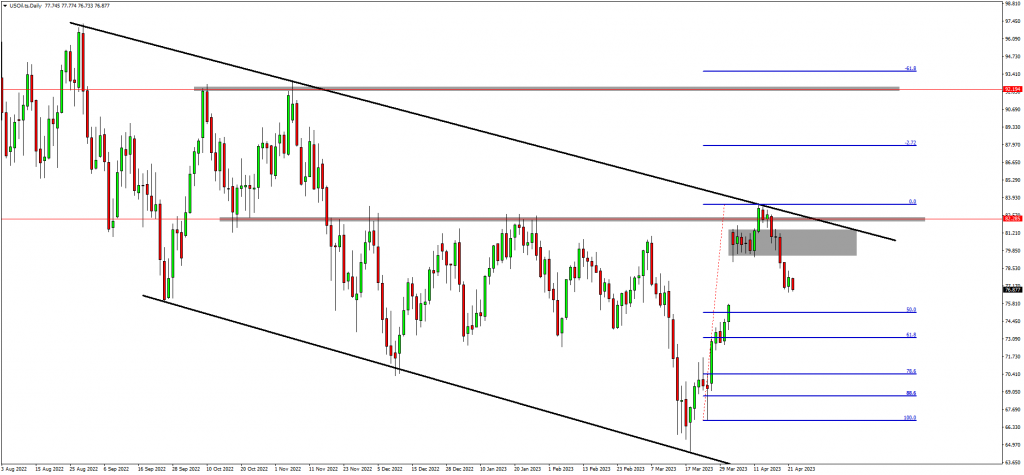

USOIL is still trading within a descending structure.

USOIL recently bounced from the top of the descending structure. This area is aligned with the resistance zone around 82.300, increasing the probability of rejection and drop. Furthermore, the market indicated more bearish momentum by breaking below the supply zone. According to this recent price action, traders anticipate USOIL to continue dropping to the 50.0 - 61.8 fib zone and as such, a correction will confirm a continuation to the downside.

The XAUUSD (GOLD) Performance

(UPDATE) - GOLD trading below the significant zone.

GOLD, a popular precious metal that is often considered a safe haven asset, has also seen a short-term bearish sentiment among traders. Historically, GOLD has been perceived as a hedge against inflation, currency fluctuations, and geopolitical risks.

However, with the recent rise in interest rates and the strengthening US dollar, GOLD has faced downward pressure. Additionally, the potential for a resolution of global trade disputes and an improved economic outlook has reduced the demand for safe-haven assets like GOLD. As a result, some traders are expecting a short-term decline in the value of GOLD.

GOLD recently broke below the ascending structure and the resistance zone around 2000.00. This price action confirmed a short-term bearish scenario and could see GOLD pushing down to the support zone around 1950.00.

Read More: Catch TD Markets at FMAS

Final thoughts on today

In conclusion, traders are expressing short-term bearish sentiment on the US30, GOLD, and USOIL due to concerns about economic data, geopolitical tensions, rising interest rates, and other factors. However, market conditions are dynamic and subject to change, and it's crucial for traders to stay informed and make informed decisions based on their individual risk tolerance. Subscribe to our YouTube today to stay informed.