USDCHF Update

Price rejected and pushed down but returned to the same area of rejection. A break above 0.86839 was the signal for the 1-minute and 5-minute traders. The target was set at a price point of 0.87280. The target was reached. The next target is at a price point of 0.88206.

Please note that this should not be used as advice, but support that can assist clients to make a more informed decision on their own. Risk Management must be applied on a strict basis.

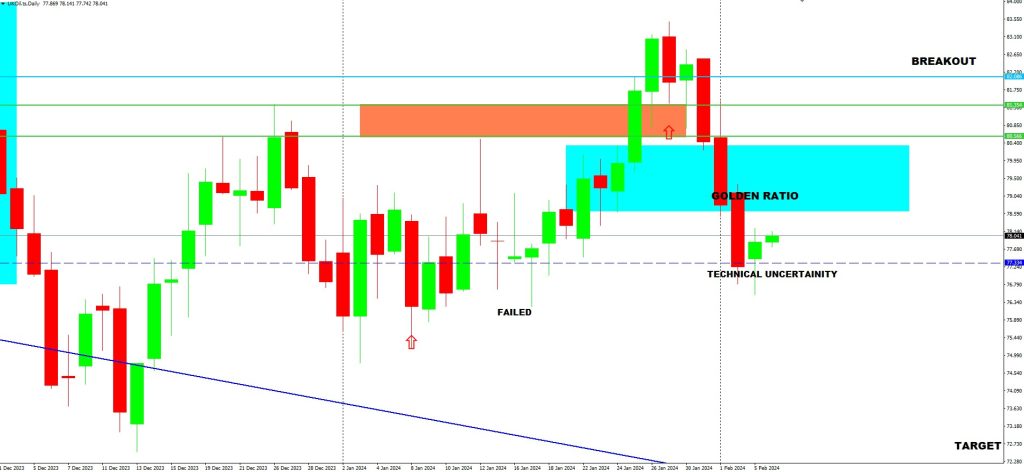

OIL Update

In an attempt to go up, oil created a significant High at the outer trend giving us a beacon to work with. The target is set at a price point of 85.762. Breakout has happened at a price point of 81.354, we now wait to see what the breakout will produce. The price has completed a move down to technical uncertainty, currently sitting at a support area of 77.334. A daily close above the Golden Ratio is a signal that the oil is geared to push further up, traders should be monitoring it very closely.

Please note that this should not be used as advice, but support that can assist clients to make a more informed decision on their own. Risk Management must be applied on a strict basis.

NZDCHF Update

This pair is still giving traders another opportunity to analyze as the move has not happened yet. Price found support at level 0.51828 with an attempt to push to the upside. The high that formed did not create another higher high for further upside. Price has pushed out of the zone creating a breakout and is currently sitting at the breakout. The target at this point is at price point 0.51828.

Please note that this should not be used as advice, but support that can assist clients to make a more informed decision on their own. Risk Management must be applied on a strict basis.

Final Thoughts On Today’s Analysis

Recent developments in financial markets, especially regarding oil prices and currency pairs like USDCHF and NZDCHF, reveal intriguing technical patterns and potential trading opportunities. In the USDCHF analysis, a critical technical zone witnessed initial rejection followed by a return, signaling a possible sentiment shift. A breakout above 0.86839 provided a signal for short-term traders, achieving the target at 0.87280, with the focus shifting to 0.88206. The oil market exhibited significant price action, attempting higher moves with a breakout at 81.354, targeting 85.762. However, a retracement to 77.334 support area adds uncertainty, emphasizing the need for caution and monitoring. NZDCHF analysis suggests ongoing opportunities as anticipated moves are yet to materialize, with attention on support at 0.51828. Emphasis is placed on informed decision-making and strict risk management amidst market fluctuations. These insights provide valuable guidance for traders, reminding them of the importance of risk management in navigating dynamic financial markets.